costa rica taxes pay

Costa Rica taxes your income according to the follow sliding scales. Properties in Costa Rica with the construction of a lower value than 100000000 about 175000 are exempt from paying the fee of 025 over your appraised value.

Costa Rica Attempts To Collect Taxes From Companies That Have Reported Losses

Yes retirees in Costa Rica do NOT pay any taxes on their foreign retirement income.

. If you have legal residency in Costa Rica chances are youre paying every month to the Caja Costarricense de. The ordinary fiscal period of the. Property taxes are paid quarterly but you can pay them in advance until the end of the.

The Costa Rican income tax rate varies based on what type of income you receive. Income tax or impuesto de la renta. 2 The Foreign Tax Credit and your Costa Rica Caja Payment.

A quick and efficient way to compare. If you generate income in Costa Rica in. Costa Rican income tax is payable on any income that is generated in Costa Rica for residents or non-residents.

The Social Security paraffiscal contribution is one of the most important taxes in Costa Rica. A resident for tax purposes is anyone who spends more than. Costa Rica Salary Calculator 202223 Calculate your take home pay in Costa Rica thats your salary after tax with the Costa Rica Salary Calculator.

The tax increases slightly each year and is due. For individuals domiciled in Costa Rica any income obtained. Property taxes in Costa Rica are low due to a tax rate of 25 of the register value per year.

Income taxes on individuals in Costa Rica are levied on local income irrespective of nationality and resident status. The Costa Rican government not only taxes active corporations those that actively do business but also inactive ones. The determines a tariff scale for legal persons whose gross income does not exceed the sum of CRC 112170000 during the fiscal period.

Costa Ricas laws require all passengers departing Costa Rica by air whether adult child or infant to pay an Exit Tax of US2900 in cash. You only pay income tax if earn an income in Costa Rica. A For Individuals Up to 3549000 per year US6227 Exempt From 3549000 6227 to 5299000.

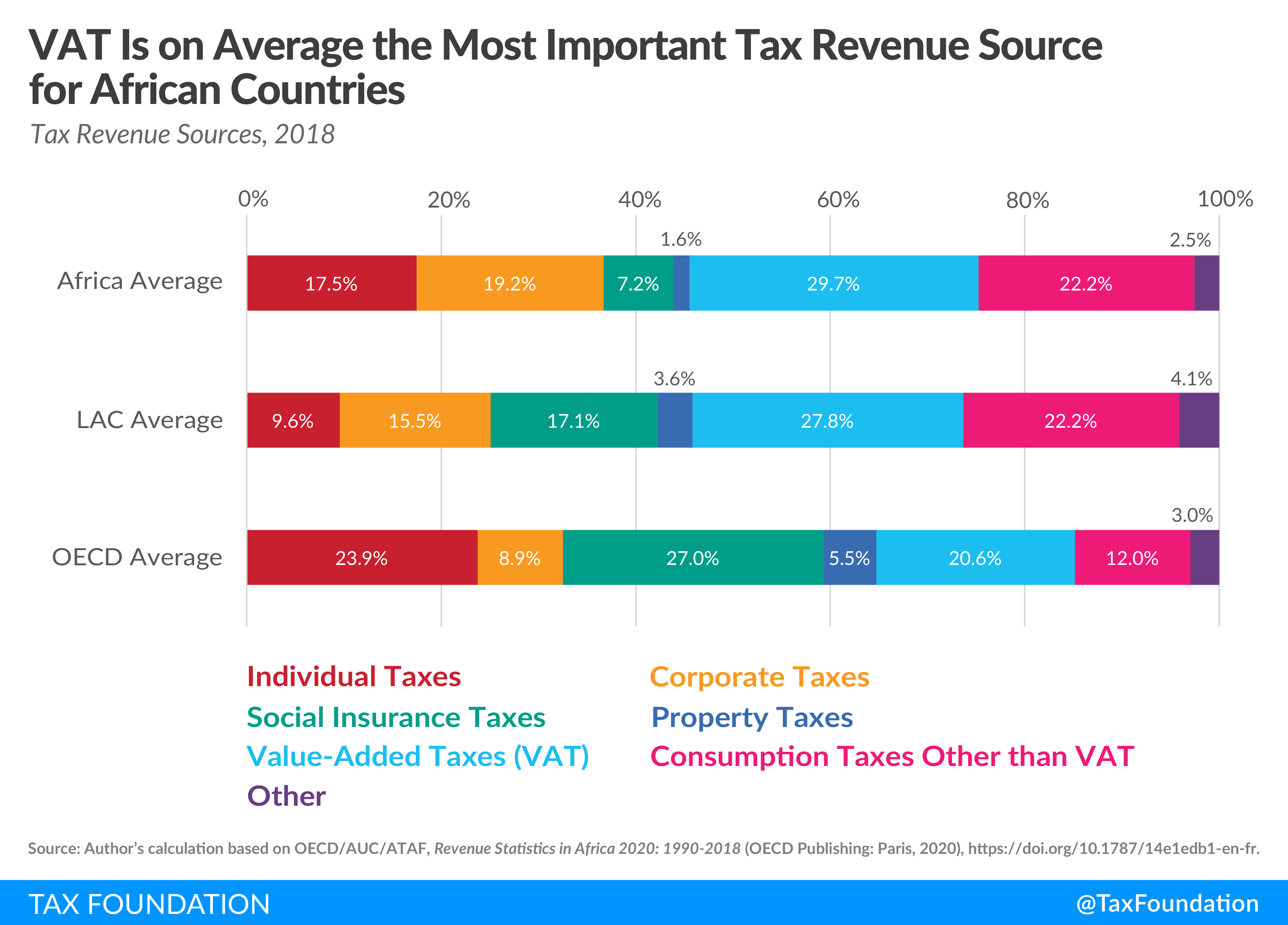

5 on the first CRC 5286000 of. Dividend and interest income are generally taxed at 15 while most capital gains are exempt from taxation. The value-added tax in Costa Rica has a rate of 13 but reduced rates apply in particular cases.

The Costa Rican government has plans to change the 13 percent sales tax into 15 percent IVA. The revenue goes into the Governments.

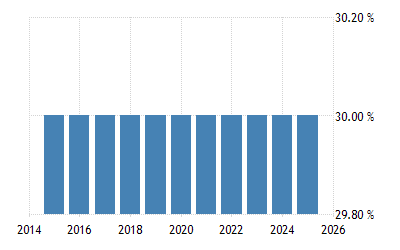

Costa Rica Corporate Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical

International Taxes In Costa Rica What You Need To Know

Pay Your Costa Rica Taxes Online The Costa Rican Times

How Much Is The Costa Rica Company Tax For 2021 Costaricalaw Com

Can I Lose My Property For Failure To Pay Costa Rica Property Taxes Tank Tops Flip Flops

Costa Rica Business Environment Taxes

Costa Rica Number Of Taxes Data Chart Theglobaleconomy Com

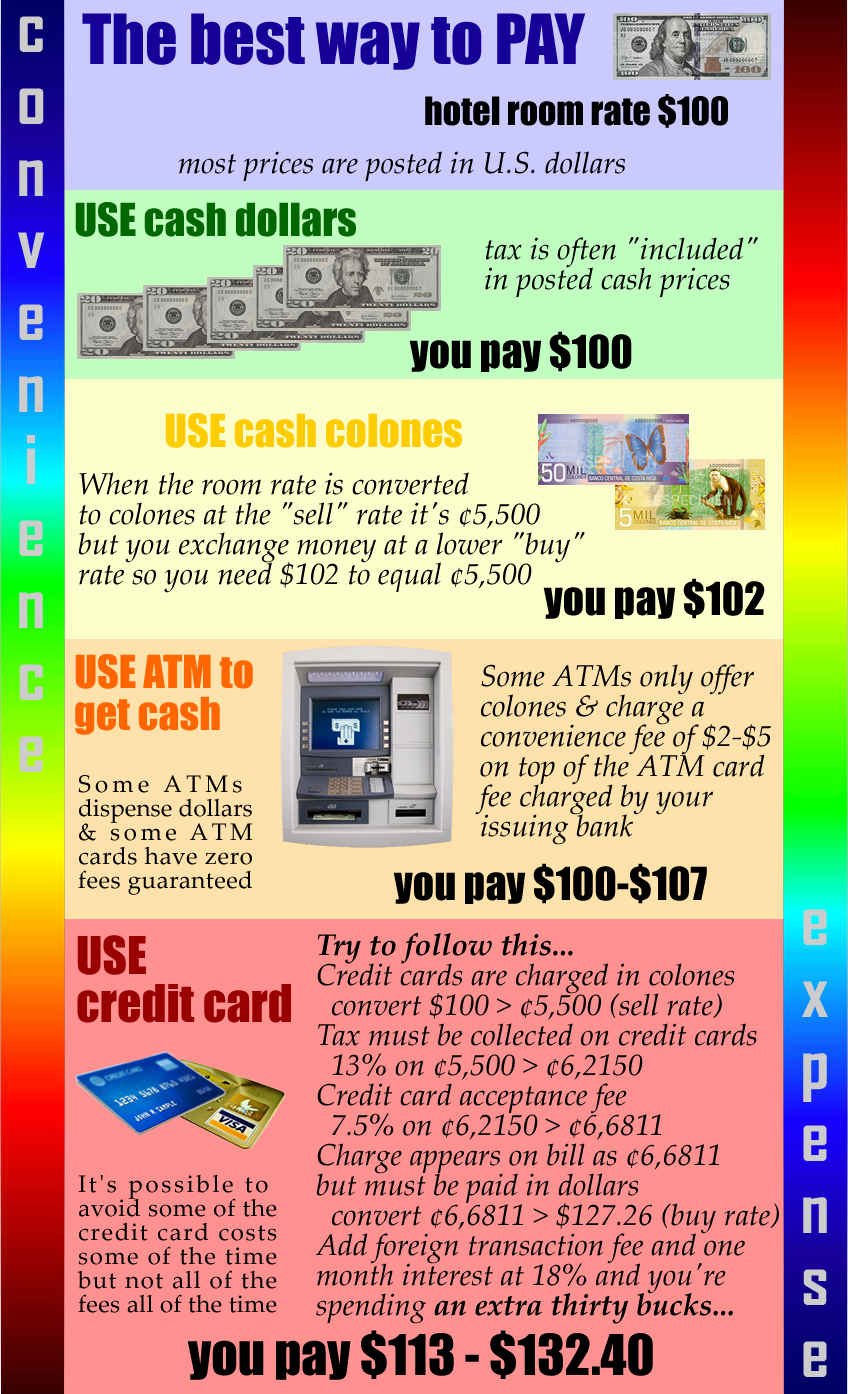

Money Getting It Carrying It And Spending It In Costa Rica

12 Top Expat Tax Tips And Services For Living In Costa Rica

Taxes The Tico Times Costa Rica News Travel Real Estate

9 Costa Rica Taxes Ideas Costa Rica Costa Costa Rica Real Estate

Offshore Tax How Does Working Remotely From Costa Rica Affect My Taxes Youtube

![]()

Everything You Wanted To Know About Costa Rican Property Taxes Costaricalaw Com

Dentons Munoz Upcoming Payment Of Corporate Taxes For Fiscal Year 2018 Costa Rica

Tax Revenue In African Countries Tax Foundation

All About The Taxes Of Costa Rica Special Places Of Costa Rica

Costa Rica Corporate Tax Urgent Changes 2017 2018 Remax Jaco

Taxes You Need To Know About When Living In Costa Rica The Tico Times Costa Rica News Travel Real Estate